Rig: Bitcoin Mining Re-imagined

A monthly newsletter by 256 Foundation

September 2025

INTRODUCTION:

Welcome to the ninth newsletter produced by The 256 Foundation and supported by Proto! August was a wild month for freedom tech; Proto launched their new mining system, Rig, and the 256 Foundation was there to cover the announcement. Additionally, Google does evil things, econoalchemist starts building a PCB assembly line, and much more. Dive into all the interesting things going on in and around the Bitcoin mining industry and catch up on the latest freedom tech news, free & open mining developments, 256 Foundation grant progress updates, and the current state of the Bitcoin network.

DEFINITIONS:

PCB = Printed Circuit Board

PSU = Power Supply Unit

APK = Android Package

FREEDOM TECH NEWS:

August 6, Roman Storm (Tornado Cash) trial ends with a conviction for one of three counts. This was a dark day indeed for freedom advocates everywhere. The jury in the Roman Storm trial found the defendant guilty on one charge, Conspiracy to Operate an Unlicensed Money Transmitting Business; as for the other two charges the jury was unable to reach a unanimous conclusion. Roman Storm never controlled the funds going through Tornado Cash, control being central to the common understanding of a money transmitting business, i.e., in order to transmit money from one place to another, the entity logically then must have control over the money. For several months leading up to the trial, this issue of control was highly contested with the prosecutors arguing that “Custody of the funds, however, is not a requirement to being a money transmitter under Section 1960. Custody is not part of the statute, and the defendants do not cite any case or other legal authority that has ever held that custody of the funds is required.”. Which is a disingenuous argument at the least and intentionally misleading at worst because bitcoin (Ethereum in the case of Tornado Cash) cannot be moved without control. Despite arguments made in the Tornado Cash case, like a frying pan transfers heat without having control over the heat; bitcoin is not a form of energy like heat is, bitcoin is an unspent transaction output which can only be sent from one address to another by meeting the spending conditions, e.g., controlling the private key or in other words, having control of the funds. The prosecution is trying to argue that since “custody” is not mentioned in the 1960(b)(1)(C) statute, custody therefore is not required to transfer bitcoin. The dangerously slippery slope that this boils down to can be summed up in one sentence, which prosecutors repeated many times: “to facilitate the transfer of funds by any and all means”. This statement and justification for the charges is so overly broad that it could be taken to mean any participant in the ecosystem, be they a software wallet developer, hardware wallet engineer, node operator, or even a miner. Conspiracy to Operate an Unlicensed Money Transmitting Business is the same charge that prosecutors were able to get a guilty plea on from the Samourai Wallet developers in a last minute plea agreement before the jury deliberation concluded in the Roman Storm case. Unprecedented charges pointing to an uncertain future where the government can manipulate any law they want to punish those who enable individual freedoms and shift power away from the State; something which all developers, builders, and industry participants should keep in mind as time moves forward.

August 9, econoalchemist sets up a free and open-source hardware assembly line to start building the free and open-source hardware being developed by the 256 Foundation. The assembly line is a private venture separate from the 256 Foundation. The equipment includes a Neoden 4 Pick & Place machine which accepts reels of small electronic components and automatically picks up the components, checks them with a camera to make sure the correct component was selected and in the correct orientation, then the work-head places the component onto the PCB in exactly the right spot on top of some tacky solder paste. Once all the components are placed, the PCB is sent through the Neoden IN6 Reflow oven where the solder paste heats up and fuses the component to the underlying copper pad. First up on the assembly line will be a few Libre Board prototypes and then a small production batch of about 100 Ember One hash boards with the Bitmain BM1362AC ASICs. Also in the production pipe line are the Adit Board v2 which gives users the ability to communicate with Antminer hashboards via USB and then the AntHat which allows users to control the Antminer fans and PSU with a Raspberry Pi via the Adit Board v2.

August 13, Google Play Store implements FinCEN Money Transmitting Business license requirements for non-custodial Bitcoin wallet app developers, then quickly walks back policy. The Rage covered the initial news of Google’s policy update saying: “Google Play Store has introduced a policy that requires any software wallet developer to obtain a license before publishing cryptocurrency wallet apps to the Google Play Store ‘to ensure a safe and compliant ecosystem for users’.“. This news sent shock waves through the industry as the implications would mean that non-custodial Bitcoin wallet developers either obtain a Money Transmitting Business license or their apps would be removed from the Google Play app store, cutting off access to millions of users world-wide. To compound the issue and add to the confusion, FinCEN has stated explicitly that non-custodial wallet developers do not need money transmitting licenses and the federal prosecutors in the Samourai Wallet case had dropped the allegation related to them not having such a license. Not long after news broke of the policy change, Google responded to The Rage on Twitter, clarifying that non-custodial wallets were not in the scope of the updated policy; the damage had already been done however and the trajectory has been made clear to all observers. Roughly two weeks later, Google then goes even further along that trajectory and outlines the implementation of a new Android Developer Verification process that will require all Android developers to upload government issued identifying documents, register their app’s package names, and upload signing keys through a revamped Android Developer Console. Google takes things a step further explaining that Android devices using Google services will no longer accept side-loaded apps that do not originate from the walled garden. In practical terms, this means that if you have an Android device then by default you will no longer be able to install apps coming from sources like F-Droid or the Aurora Store or downloading and installing the direct .APK file. Your device will only run apps that come from the Google Play Store and in order for apps to get into the Google Play Store, the developers will have had to comply with the new requirements. This means it is your device but their rules and developers will no longer be able to protect themselves behind a pseudonym if they want their projects available to the millions of users who get their apps from the Google Play Store. People who buy an Android device, like a Google Pixel, and flash it with an alternative operating system like GrapheneOS will still be able to obtain apps from where ever they want.

FREE & OPEN MINING DEVELOPMENTS:

August 4, Dr. Con Kolivas releases an easy to deploy Solo CK Pool package. Acknowledging that hosting Solo CK Pool prior to this new release requires an advanced understanding of the software, this all-in-one script automates the process. There are some key highlights from the post that resonate with the 256 Foundation’s mission and address some of the same issues we are tackling with Hydra Pool, which tells us we are on the right track: Make the software accessible to anyone, even non-developers and make spinning up a new pool quickly deployable.

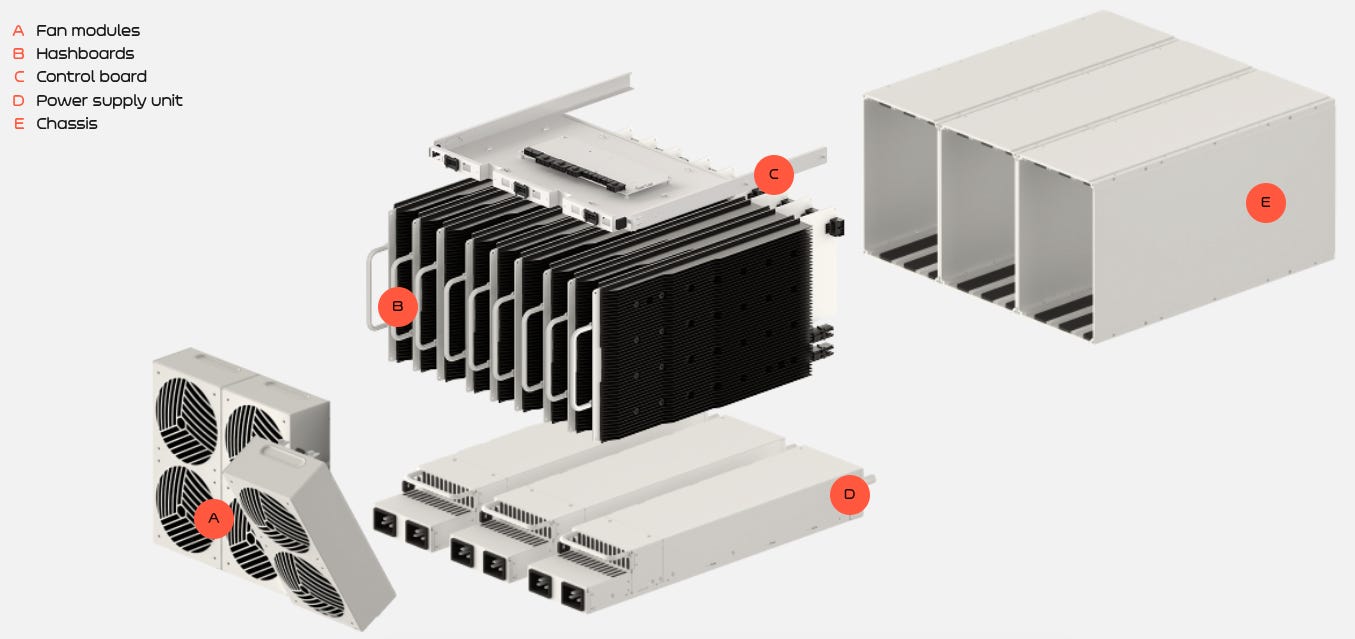

August 14, Proto Mining Launches their new mining system, Rig, intriguing miners all across the Bitcoin industry. What Proto has accomplished with Rig is so simple yet so effective: the idea of being able to swap components out quickly, without tools, and while the miner is still running. Once you see it, it’s so obvious in hind-sight that this is how every mining system should be; easy to maintain, inexpensive to upgrade, and designed to maximize up-time. Proto knocked it out of the park with Rig. Rig is a densely packed power-house of a miner; boasting up to 819 Th/s with all nine hashboards installed, power efficiency as low as 14.1 J/Th, and a power consumption of up to 12,000 Watts. Weighing in at 110 LBS, Rig has the hashing capabilities of three new-gen Antminers but only takes up the space of two Antminers. Each Rig unit has three bays and each bay contains one double fan assembly, three hashboards, and a power supply unit. The fans, hashboards, and PSU’s can all be swapped out by-hand without the use of any tools and while the other two bays continue hashing. Swapping out these components is as simple as pressing a latch, pulling the old component out, and snapping the new component into place; it literally takes a few seconds.

Compare that with an Antminer or Whatsminer where the miner needs to be powered off, the whole machine needs to be removed from it’s rack position, then disassembled using a screwdriver on each component, and then reassembled and reinstalled. Even once the miner is back in place, getting back up to nameplate hashrate can take as long as 30-minutes in the case of Whatsminers. The control board in fleet can be easily accessible by depressing two latches on the sides of the unit but then a screw driver is needed to remove the control board. The Rig approach means that the miner chassis becomes part of the permanently installed infrastructure. Beyond the hardware, Proto also launched Fleet, the miner management software, offering users a sleek interface with a substantial number of the miner’s parameters accessible from the GUI. Fleet also offers simple error handling, built-in diagnostics, and smart alerts to help maximize up-time; additionally, users can also fine tune power and performance by quickly and easily optimizing for hashrate, power usage, or overall efficiency across individual miners or their entire fleet. There are a number of additional features in the works such as an AI-Powered Dashboard, direct parts ordering, and automated curtailment settings. Fleet also works on mobile so users can always stay connected to their mining sites. The Fleet software is currently in closed Beta but those who are interested in helping test the software can easily gain access by making a request through Proto’s website here. Proto has committed to making Fleet free of charge and open-source once it is fully released. The mining firmware will also be released open-source but in a staggered stage after fleet. As for the hardware side of things, I personally did not get the impression that the hardware designs would be made open source but I don’t have anything specific to cite from Proto on that, they may surprise us. I do get the impression that Proto will be open to selling their mining ASIC chips a la carte with supporting documentation; however, again I don’t have anything from Proto to cite on that front but stay tuned. 256 Foundation was present during the launch event, which started at the McLemore Resort near Dalton, GA where guests enjoyed a reception event and opportunities to mingle afterwards. The following morning all guests traveled to a Core Scientific mining facility to participate in the product launch event. That evening, there was a Beef Steak dinner held for all guests back at the resort. We held a live POD256 from the middle of the action both nights and you can listen to those recordings here for night 1 and here for night 2.

August 14, @mononautical composes thread on sub-sat summer, explaining the risk vs. reward for pools accepting transactions paying less than 1-sat/vB. The sub-sat summer trend started with Mara trying to boost mining rewards during an extended period of low demand for block space. By accepting transactions paying less than the standard 1-sat/vB, Mara was able to fill block space with more transactions thus making their total mining rewards increase. Transactions offering less than 1-sat/vB are non-standard though, so it takes nodes with the default settings longer to validate blocks containing these transactions. The longer it takes nodes to validate a block, the more risk there is in that block being orphaned by another block that can be validated and propagated faster. Mononautical explains that data reveals there have been a total of 11 orphaned blocks between block height 900,000 and 910,000. Of those 11 stale blocks, only one of them contained sub-1 sat/vB transactions. At block height 906,343 Antpool had a block orphaned by Foundry and lost their entire 3.145 BTC mining reward. Mara has since reverted back to the standard 1-sat/vB minimum transaction fee. Other pools are likely to follow in an attempt to mitigate risk.

August 17, Solo CK Pool block find at height 910,440 from a miner with 9Ph/s, making this the 12th block find for Solo CK Pool this year.

August 22, Tyler Stevens upgrades Bitcoin mining heated floor system at the Space Denver. The new configuration allows them to keep the miner running so long as the roof-top solar power system has the output capacity to keep the miner running; why waste that solar energy? But what about in the summer time when the heated flooring system would make it uncomfortably hot inside the building? Tyler cleverly connected a remote activated pump to the system so that when it is getting too hot inside the building, they can kill the pump and the heat is directed to a radiator mounted on the exterior of the building. The radiator dispenses the heat to atmosphere out doors, preserving a comfortable climate indoors while still utilizing the otherwise wasted solar power output.

August 26, @boerst adds events panel to stratum.work enabling users to monitor fork events on-chain, invalid templates, and soon to be more interesting conditions. There have been instances of invalid mining jobs being passed out by Antpool and others where the Merkle branches are empty yet the coinbase reward totals more than the subsidy; in other words, fees were included for non-existant transactions. Had a miner found a golden nonce while working on one of these faulty jobs, it would have resulted in an invalid block getting mined. Theories on what’s going on range from a botched selfish mining attack to glitchy template code but there will need to be more evidence collected before the root cause can be definitively identified. Bitcoin researcher b10c wrote an in-depth analysis on invalid mining jobs by Antpool and friends during forks, you can find it here for more details.

GRANT PROJECT UPDATES:

Ember One

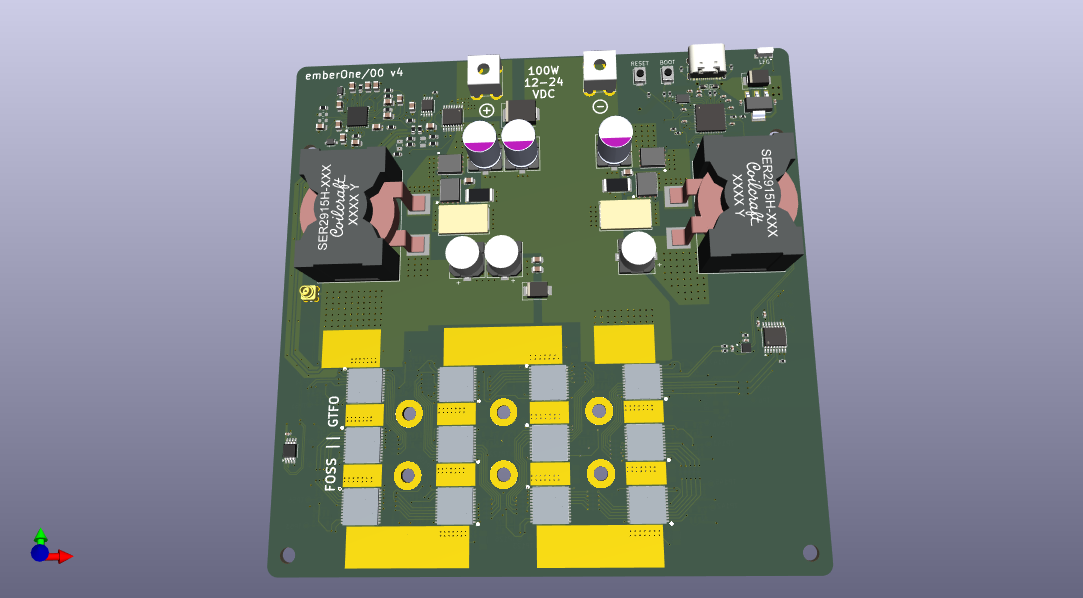

Skot was able to complete the validation process on Ember One v4. This hashboard is now ready to go into production. Anyone is free to grab the production files from the GitHub repo v4 branch and start manufacturing and distributing these units. We will be following up with an official release of v4 in the days ahead. Ember One is a ~100W hashboard built around the Bitmain BM1362AC ASIC chips and it capable of producing roughly 3.5Th/s. This is unlike the Bitaxe in that the control board is separate. This is the hashboard only and all peripheral equipment like the control board, firmware, power supply, heatsink, and fan are separate. We will be pointing to reference components for those separate items in the weeks ahead as these hashboards get manufactured and we can test different components. Learn more at emberone.org.

Libre Board

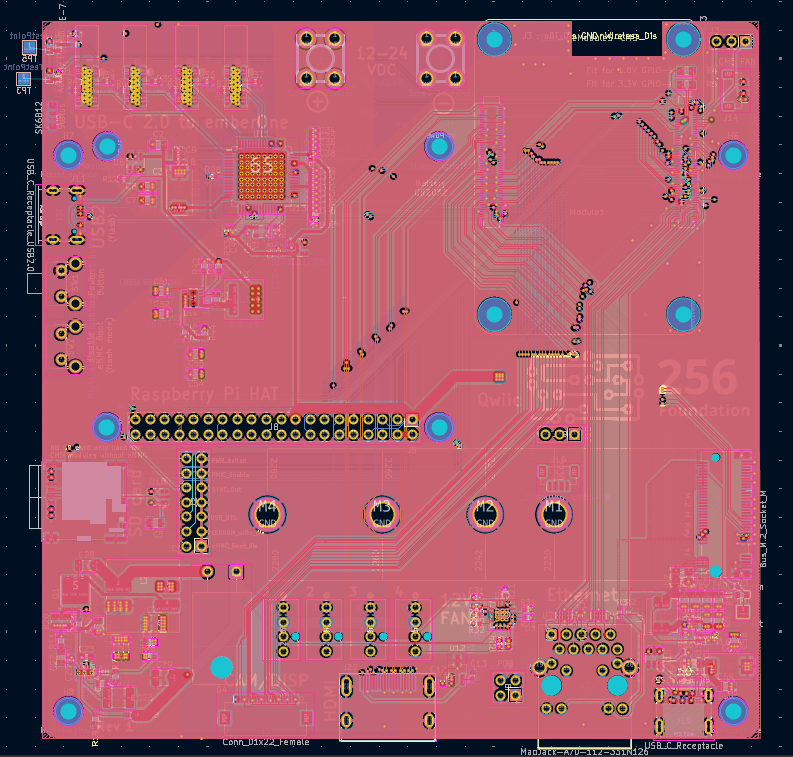

Schnitzel was able to complete the tracing of the components on the Libre Board through the 6-layer PCB. There was also some work that needed to be done on the Bill of Materials to update information from the original Raspberry Pi I/O Board design. For example, some components were specific to the U.K. and not readily available in the U.S., the data sheet references needed to be updated, and a few other things needed to be standardized and cleaned up. After getting everything just about finished we decided at the last minute to upgrade the voltage regulators for both the 12v output and the 5v output to newer voltage regulators that have Inter-Integrated Circuit (I²C) interfaces which will allow the Libre Board to know how much power is connected to it and how much draw there is on both the 12v and 5v lines, which can be helpful for monitoring fans and overall power consumption. The voltage regulator upgrade will require about 10 components to be changed along with their tracings. After this last change is complete then we will make a few prototypes from this design and begin the validation process. Learn more at libreboard.org.

Mujina Firmware

While @ryankuester awaits the Ember One hashboard, he’s been developing Mujina with the Bitaxe Gamma as a stand-in miner, simulating the mining functions. That has allowed him to start flushing out much of what surrounds the hash boards: discovery, hot-plugging, monitoring, logging, pool communication (stratum v1 client only for now), work distribution, API infrastructure, and the start of the CLI and TUI clients of that API. It’s a work-in-progress, but an entire system is taking shape. Eventually, Mujina will be it’s own Linux image. Skot is sending Ryan an Ember One prototype this week so he can work on its unique drivers and integration into the system in time for an initial release and inauguration of the open source community, concurrently with the first Ember Ones rolling off the assembly line and shipping to testers and developers. You can learn more at mujina.org.

Hydra Pool

Jungly has been monitoring the Hydra Pool test server announced in last month’s newsletter for various Bitcoin mining hardware and firmware types to connect. These test have been helpful to ensure the Hydra Pool server can communicate appropriately with a wide range of hardware types. Over 30 different kinds of miners connected and exposed a number of issues that we needed to resolve. We are confident now that the Hydra Pool server can handle it’s job of communicating with a wide range of clients no matter how they are presenting the Stratum data. Users interested in seeing what a pool server’s logs look like when connecting to Stratum clients can download log files from test.hydrapool.org, IP addresses have been removed. Then Jungly was able to move on to building the PPLNS payout mechanism. This is going to enable users to host an instance of Hydra Pool for others to join and ensure the rewards are handled in a non-custodial manner as they will be paid from the coinbase transaction. Hydra Pool will not limit itself by Bitmain’s arbitrary coinbase payout participant limits, which is some 16 addresses maximum in the coinbase reward. Users of Hydra Pool will be able to configure this number to whatever they want, anyone using an old stock Antminer should be aware that it will not handle a template with more than some 16 payout addresses. Over the last month, we also explored how the Hydra Pool server will store share data, calculate the PPLNS share window, and make that data available for auditing so users can ensure their Hydra Pool host is being honest. We decided that since the server will be validating all incoming shares anyways that instead of putting the database resources on the server, we will just open up an API so anyone can monitor what the pool is validating and then the person doing the monitoring is free to compile as much of that data as they want for their own calculations. There will still need to be some persistent storage built into the server so that in the event of a server crash or restart, all the work is not lost. We are anticipating having the first release of Hydra Pool out next month, stay tuned for announcements. Learn more at hydrapool.org.

STATE OF THE NETWORK:

Hashrate on the 14-day MA according to mempool.space increased from ~913 Eh/s on the first day of August to ~966 Eh/s by the end of the month, marking roughly +5.8% increase for the month. The year to date hashrate difference is +22.9% using the 14-day MA up until the last day of August.

Difficulty only went up in August, starting the month at 127.62T and finishing at 129.7T, marking a 1.6% increase for the month. All together for 2025 up to Epoch #452, difficulty has gone up ~18.1%.

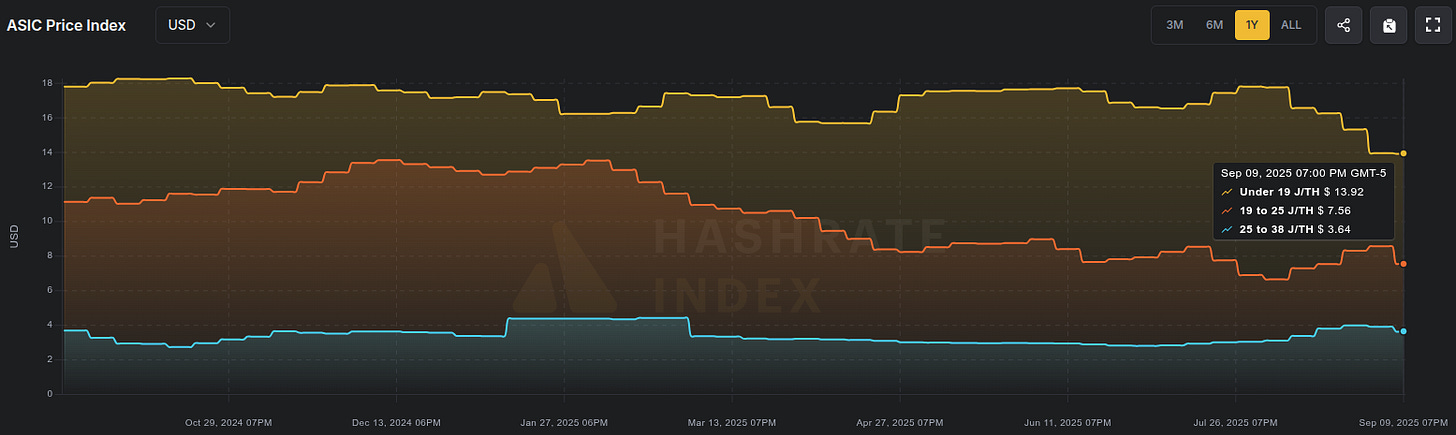

According to the Hashrate Index, new-gen ASIC prices have decreased over the last month. The more efficient miners like the <19 J/Th models are now fetching $13.92/Th, down from $17.94/Th last month. Models between 19J/Th – 25J/Th are selling for $7.56/Th, up from $6.52/Th. Models >25J/Th are surprisingly higher in price this month over last, fetching $3.64/Th now compared to $3.04/Th last month.

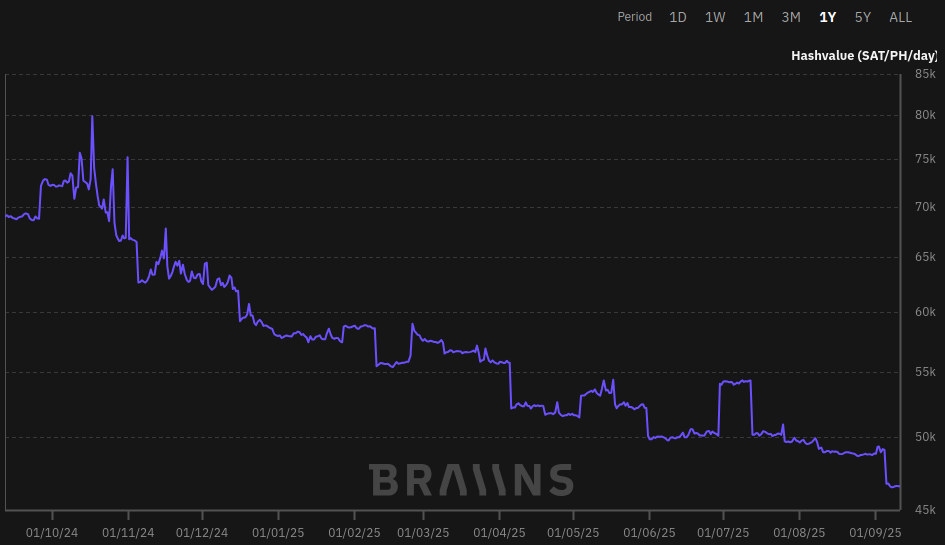

Hashvalue over the month of August stayed relatively flat throughout the month hovering around 49k sats/Ph/day, according to the Braiins Insights dashboard.

The next halving will occur at block height 1,050,000 which should be in roughly 929 days or in other words ~135,500 blocks from the the time this newsletter is published.

CONCLUSION:

Thank you for reading the ninth 256 Foundation newsletter. Keep an eye out for more newsletters on a monthly basis in your email inbox by subscribing at 256foundation.org. Or you can download .pdf versions of the newsletters from there as well. You can also find these newsletters published in article form on Nostr.

Live Free or Die,

-econoalchemist